Keep in mind that the deductible and out-of-pocket maximum describe two different concepts: the deductible is just how much you'll pay for a covered procedure before your insurance coverage starts to pay, and the out-of-pocket optimum is the total amount you'll spend for care including the deductible - What is a deductible in health insurance. A copayment, frequently shortened to simply "copay," is a set amount that you spend for.

a particular service or prescription medication. Copayments are one of the manner ins which health insurers will split costs with you after you hit your deductible. In addition to that, you might have copayments on particular services prior to you strike your deductible. For example, numerous health insurance plans will have copayments for physician's sees and prescription drugs before you hit your deductible. Coinsurance is another method that health insurance companies will divide costs with you. Unlike a copayment, coinsurance isn't a repaired expense it's a portion of the expense that you pay for covered services. For instance, if you have a coinsurance of 20%, you'll pay 20 %of the expense of covered services up until you reach your out-of-pocket maximum. The optimum out-of-pocket quantity, likewise called the out-of-pocket limit, is the most you 'd ever.

have to pay for covered healthcare services in a year. Payments made towards your deductible, as well as any copayments and coinsurance payments, approach your out-of-pocket limitation. Regular monthly premiums do not count. How does health insurance work.( The 2019 out-of-pocket limitations were$ 7,900 for an individual plan and$ 15,800 for a household strategy.) Keep in mind that the optimum out-of-pocket is a consumer security enacted under the ACA; formerly plans didn't need to top what a person would be required to invest in healthcare services. This typically suggested that insured people who had to go through very expensive treatments( e. g., for cancer or lifesaving surgical treatment) could face limitless medical.

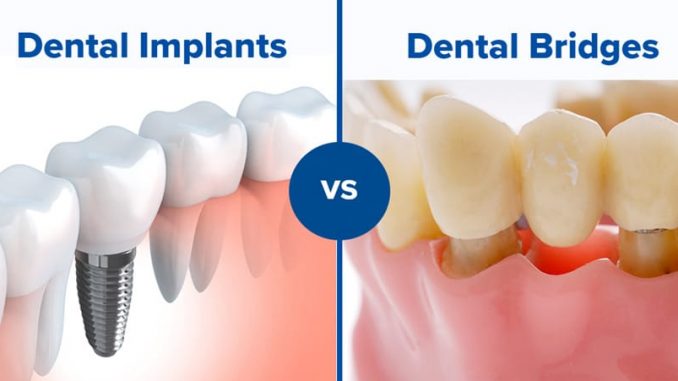

bills. Medical insurance does not constantly cover every aspect of your physical health, or your health-related expenses, which is why you can purchase additional health insurance items in addition to your medical insurance strategy (What is whole life insurance). Dental insurance coverage is an insurance item developed to assist you spend for dental care. Many dental plans are structured similarly to health insurance plans: there are dental HMOs and PPOs, for instance. Dental plans are fairly inexpensive even the most robust strategies on the market tap out at around$ 30 per month for an individual. To find out more about dental insurance coverage and how it compares to dental discount rate plans, have a look at our guide. Keep in mind that dental insurance coverage is usually consisted of in health insurance coverage prepare for children under the age of 18. Vision insurance is, you know, for your eyes. It's created to assist individuals pay the costs of routine eye examinations, eyeglasses, and contact lenses. Elective vision-corrective surgical treatment might be covered by a vision insurance coverage plan. Vision insurance prepares normally cost around the like dental insurance coverage strategies. http://claytonykfn000.trexgame.net/the-definitive-guide-to-how-much-does-life-insurance-cost Keep in mind that vision insurance coverage is normally consisted of in medical insurance strategies for kids under the age of 18. Gap insurance is a supplemental medical insurance policy that assists you spend for out-of-pocket costs associated with your health care expenses. Developed to cover the" space" in coverage left by strategies with high deductibles, space insurance can assist you decrease your out-of-pocket expenditures. Space insurance strategies are not regulated by the Affordable Care Act, and do not offer the same consumer securities as qualifying health coverage. For instance, Alzheimer's illness, cancer, and stroke are 3 diseases that a critical illness insurance policy might cover. Each important health problem policy has its own list of diseases that it will cover. If you are diagnosed one of these health problems while you're a policyholder, your insurance company will normally pay you a lump sum cash payment. If you own a term life insurance coverage policy, you can also get an important illness rider connected to your life insurance coverage policy for less cash than a different vital health problem strategy. The Affordable Care Act, also referred to as Obamacare, made covering particular health care services a requirement for.

Little Known Facts About What Is Renters Insurance.

all medical insurance prepares available to customers. These 10 categories of services are: Ambulatory client services (outpatient care that you can get without being admitted to a healthcare facility )Hospitalization for surgical treatment, over night stays, and other conditions, Pregnancy, maternity, and newborn care, Mental health and substance utilize condition services, Corrective and habilitative services and devices( treatment and devices concerts nashville august that help individuals get or recuperate mental and physical skills after an injury, special needs, or start of a chronic condition) Lab services Preventive and wellness services, along with chronic illness management, Pediatric services, including dental and vision protection for children, Note that these.

are categories of services, and that the specific services offered within these classifications might differ from one state to another. State, federal, and private exchanges will reveal you precisely which services each plan covers before you use. One thing personal health insurance is not needed to what timeshare means cover is long lasting medical equipment( DME ), such as wheelchairs and ventilators. Because lots of people depend on this life-saving devices, make sure to get a medical insurance plan that offers protection for DME.All health insurance coverage prepares on government-run marketplaces use a set of preventative health care services, such as shots and screening tests, at no expense to strategy members( even if you haven't strike your deductible ). Since 2019, these are the 21 complimentary preventive services, as outlined by Health care. Look at your strategy or.

talk with your insurance company to check which preventative services are complimentary for you.Women and children have their own set of preventive care benefits. For females, numerous of the free preventative care advantages belong to pregnancy, breastfeeding, and contraception, in addition to gender-specific cancers and sexually transmitted illness. For children, totally free preventive care is more concentrated on developmental disorders and behavioral issues, as well as screenings for typical chronic health problems that can develop in children. Thanks to the Affordable Care Act, there are only 5 aspects that go into setting your premium: Your age, Your area, Whether or not you use tobacco, Individual v. a family plan, Your strategy category( Bronze, Silver, Gold, Platinum, or Catastrophic) Health insurance coverage companies are not permitted to take your gender or your existing or previoushealth history into account when setting your premium. Health insurance coverage premiums on the Affordable Care Act's markets have increased steadily due to numerous various situations, consisting of political unpredictability along with the expense of doing organization. Additionally, while average premiums for the benchmark second-lowest-cost Silver plan will fall slightly in 2020, costs differ commonly by state and insurance market. Over 9 million people who got health care through markets received tax credit aids in 2019, even more lowering the real cost of health insurance.